This article is based on a Chinese-language report on China's economy in 2021 from the macroeconomy research team under the Thought Leadership project of Peking University's Guanghua School of Management. It was jointly penned by Liu Qiao,Dean of Guanghua and Yan Se,associated professor of applied economics with Guanghua.

1.China's GDP may near 9% in 2021

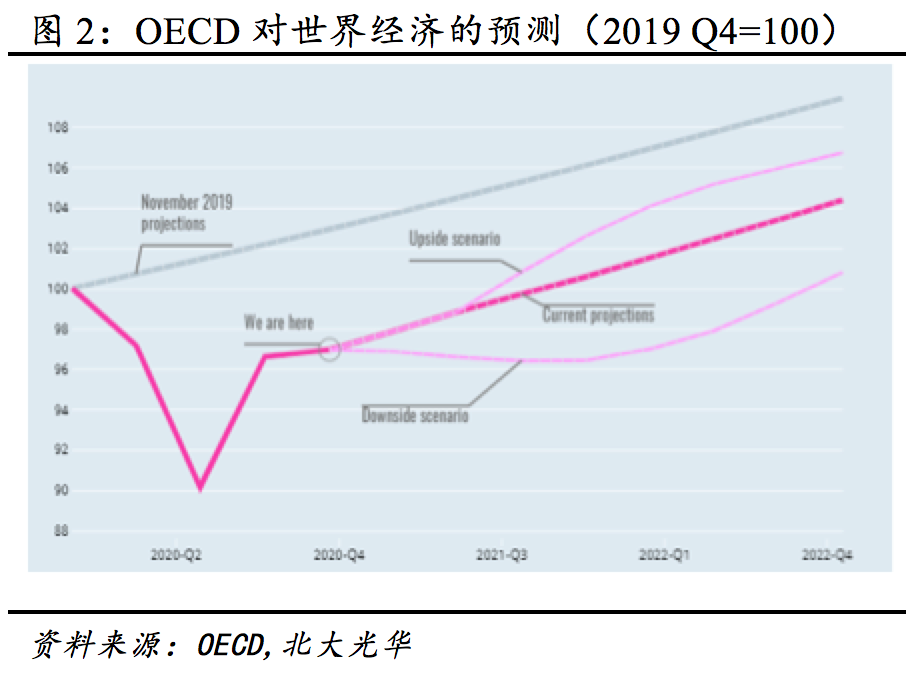

The global economy will remain under pressure in the near future.Covid-19 was the leading factor behind the stressed global economy in 2020. While several vaccines have shown promising results and the global economy is on its path of recovery this year as vaccination against covid-19 is under way,GDP growths will be lower than what is expected in a normal,coronavirus-free scenario.

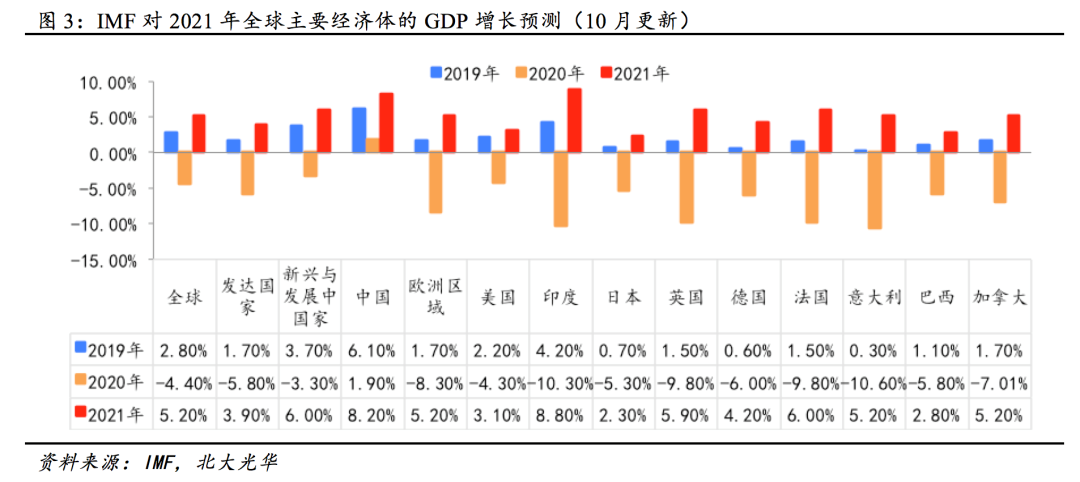

In China,free vaccination nationwide will help stimulate its economy,and the country’s 2021 GDP growth is expected to close in on 9 percent.On Dec. 31 2020,the vaccine developed by China National Pharmaceutical Group Corp.,also known as Sinopharm,was officially approved by the country's drug watchdog for nationwide use,paving way for steady vaccination progress.Due to low base effect,first quarter growth is estimated at around 18 percent,followed by 9 percent,6 percent and 5.5 percent in the ensuing quarters respectively,drawing closer to China’s long-term potential growth rate. Based on this,we expect China’s 2021 GDP growth to reach between 8.2 and 9 percent.

chart 2: OECD's forecast of global economy

chart 3: IMF's forecast for main economies'GDP growth in 2021(updated in Oct.)

2.Economic growth will gradually slow in 2021,and pressure will remain in the later half.

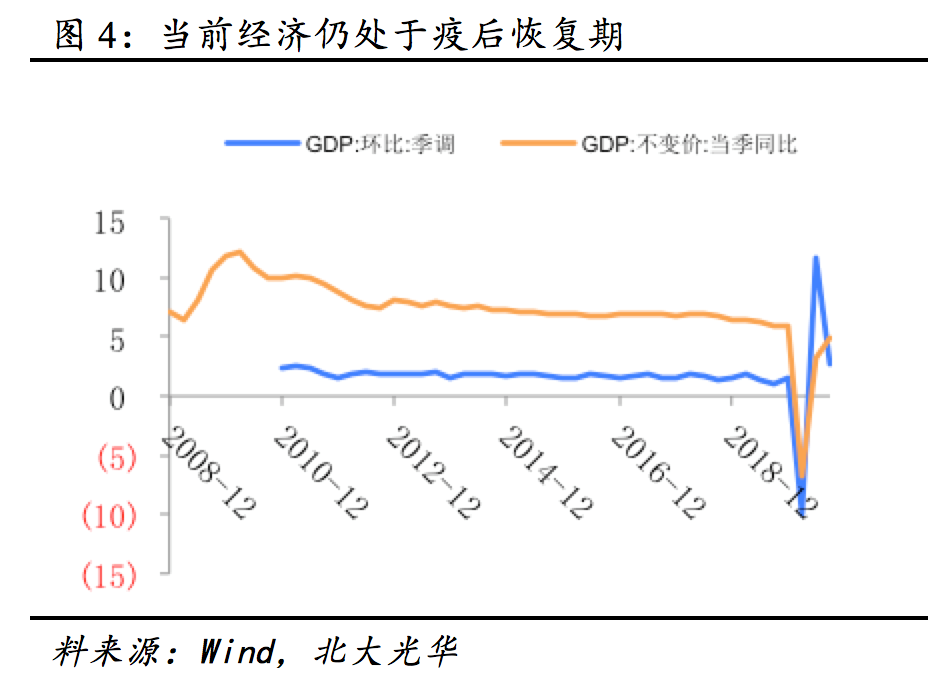

Thanks to timely and accurate policy support,China's economy witnessed a V-shape turn last year,and its GDP in the third quarter reversed a negative trend to embrace positive growth. However,the foundation for economic recovery is not solid. Real estate investment,infrastructure investment and export and import,areas that usually fuel growth,will face policy adjustment,fiscal pressure and uncertain overseas demand. Recovery in retails will lag behind,and it will take time for domestic demand to bounce back. First quarter growth will be huge due to low base effect and people should refrain from being overly optimistic. As the recovery momentum becomes increasingly weak — especially in the later half when the economy is back on track — pressure for growth will return.

chart 4: Economy is currently still recovering from Covid-19

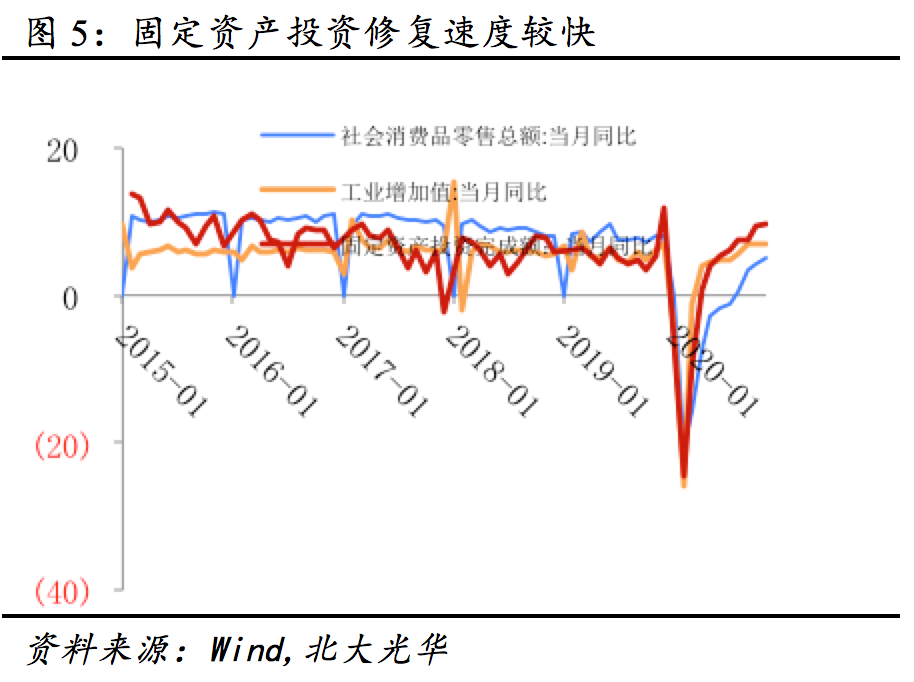

chart 5: Fixed asset investment bounces back fast

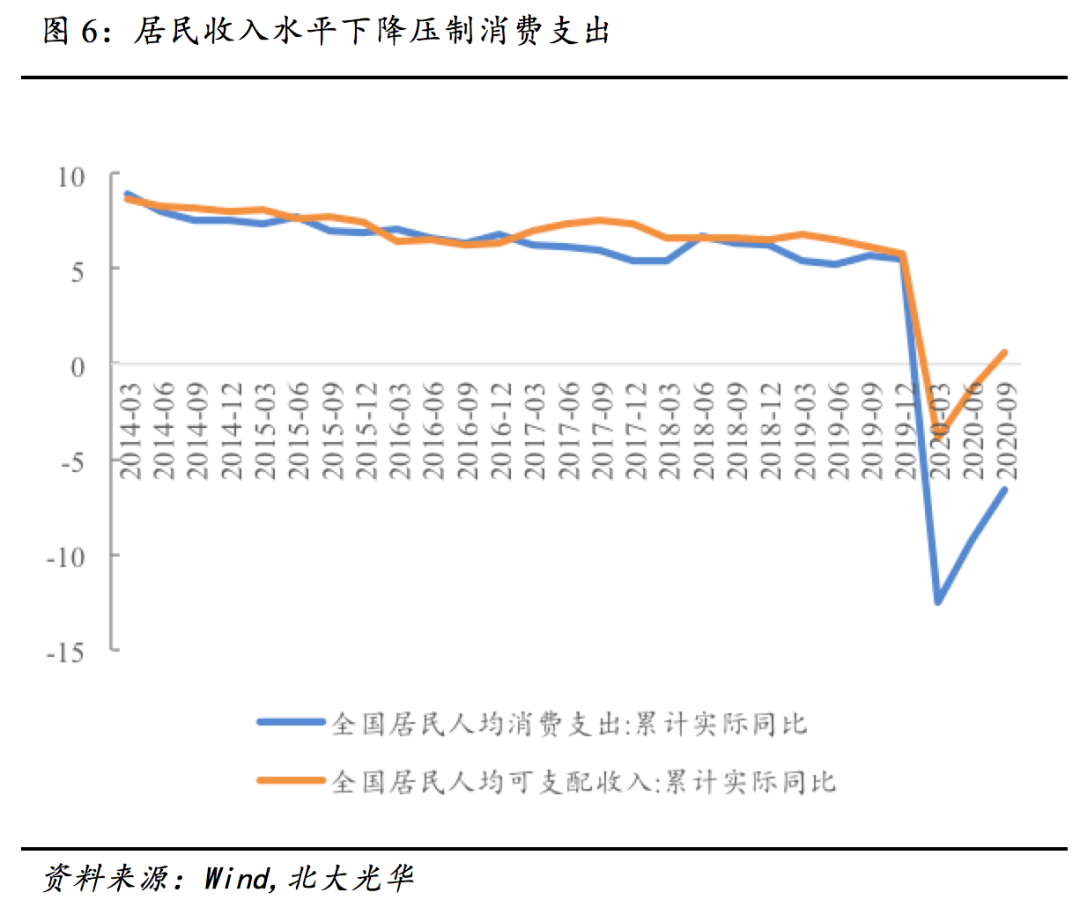

Lower income growth for citizens will increase pressure on spending,and it will take time for domestic demand to rebound.The pandemic dragged down people's income growth notably last year,leading to more preventive deposits and lower marginal propensity to consume. These are all factors that will hold back recovery in consumption.

chart 6: Lower income growth holds back consumption

Investment should focus on the repair of manufacturing and reduce reliance on real estate and infrastructure.Space for real estate investment was limited last year,and some level of contraction in 2021 is possible under credit restraint. Due to fiscal tightening,this year's infrastructure investment growth might be lower than 5 percent. Meanwhile,it is our belief that manufacturing investment will have more space for growth in 2021,especially in the hi-tech realm. Manufacturing investment in Dec. 2020 is estimated at more than 10 percent,with double-digit growth maintained in the first half of 2021 and annual growth surpassing 8 percent.

Export and import will be under greater stress in the later half of 2021.While China's export in the first half will hopefully persevere,it will be under pressure in the later half as the global economy is back on track and overseas manufacturing recovers. Export might see zero growth.

Low level inflation indicates that endogenous growth drive is still inadequate.Due to a high base effect,CPI in the first half of 2021 will continue to hover at a low level. As the global economy walks out of the shadow of Covid-19 in the later half,commodity prices are expected to rebound and push CPI higher. CPI throughout 2021 might be around 2 percent.

China's yuan will maintain strong performance in the first half of 2021.China's perceived high-level economic growth and the U.S. GDP's decline in the first half might lead to a stronger yuan,with the US dollar/Chinese yuan exchange rate hitting around 6.2.Due to reduced current account surpluses in the later half,the Chinese yuan will weaken slightly to a level of 6.5.

China future economic trend is closely related to its structural transformation and industrial upgrades. First,consumption will play an increasingly important role.Under the new economic development pattern of "dual circulation”(domestic market as the mainstay while letting internal and external markets boost each other),China will shift its focus from export,infrastructure and real estate investment to consumption as the main growth engine.Second,science and technology innovation will boost manufacturing upgrade to help wean investment off excessive reliance on real estate and infrastructure.Between 2021 and 2025,China will strengthen policy support for core technology and investment in high-end manufacturing will contribute more to the country's economy.

3.Monetary and fiscal policies compliment each other

World-wise,many central banks cut rates to cope with the pandemic and policy loosening will continue for some time.Central banks in Europe,the U.S. and Japan have said they would not increase interest rates in the near future. Meanwhile,China is sticking to its normal monetary policy. It is our belief that monetary policy has numerous functions and should not be tightened too fast for the sake of employment and the balance of payments as the effect of Covid-19 still remains and the global situation remains complex. Efforts to switch monetary policy from relaxed to stable should be steady and gradual.

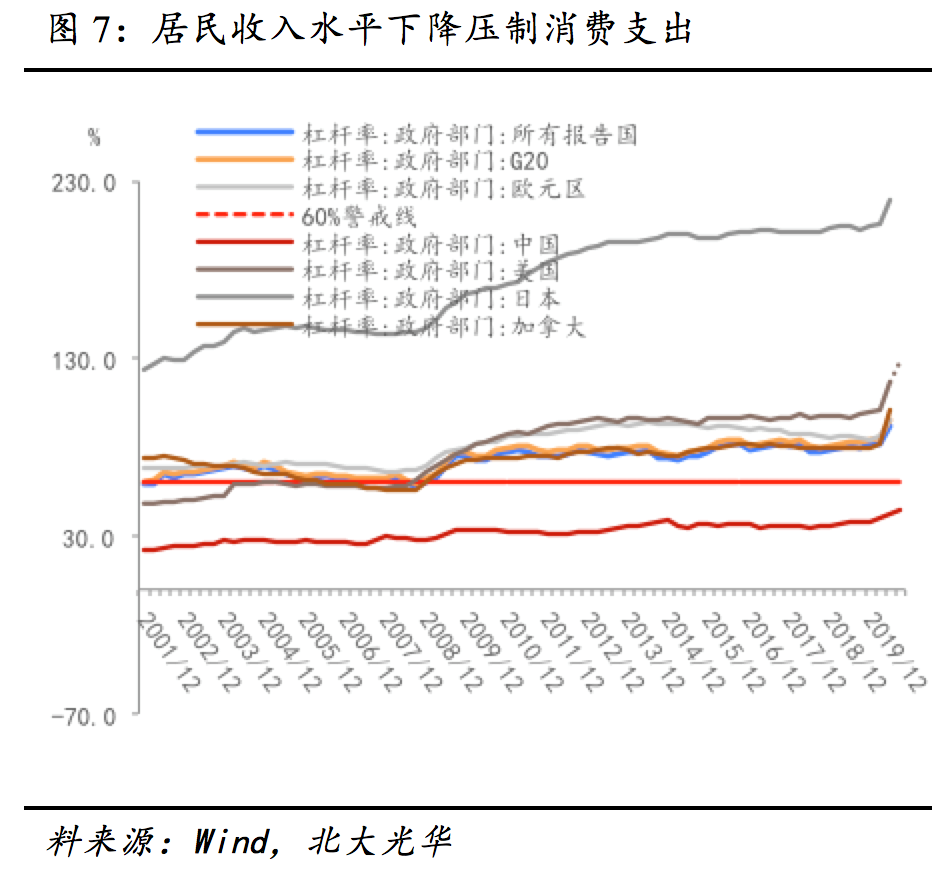

There are three reasons behind this argument.First,as the global leverage ratio soars,China’s leverage ratio is relatively moderate and stabilizing it is enough.Leverage ratios in the G20 groups of rich countries had been 20 percentage points higher than the alert level prior to Covid-19. Figures show thatglobal leverage ratios in the second quarter of 2020 were 10.1 percentage points higher than the first quarter, with the U.S. and Canada reporting over 15 percent increase. Meanwhile, China’s increase was only 2.3 percent. China's pressure from its leverage ratio is far limited compared with overseas countries, and there's no need to reduce it in haste.

Second, monetary policy has notable influence on long-term interest rate, and the rate of return has widespread influence on the real economy. Consequently, China should not increase interest rate too early. What's more, interest rate increase will result in greater rate gap between China and the U.S. and lead to even stronger yuan.As overseas manufacturing recovers, it will be bad for China’s export businesses.

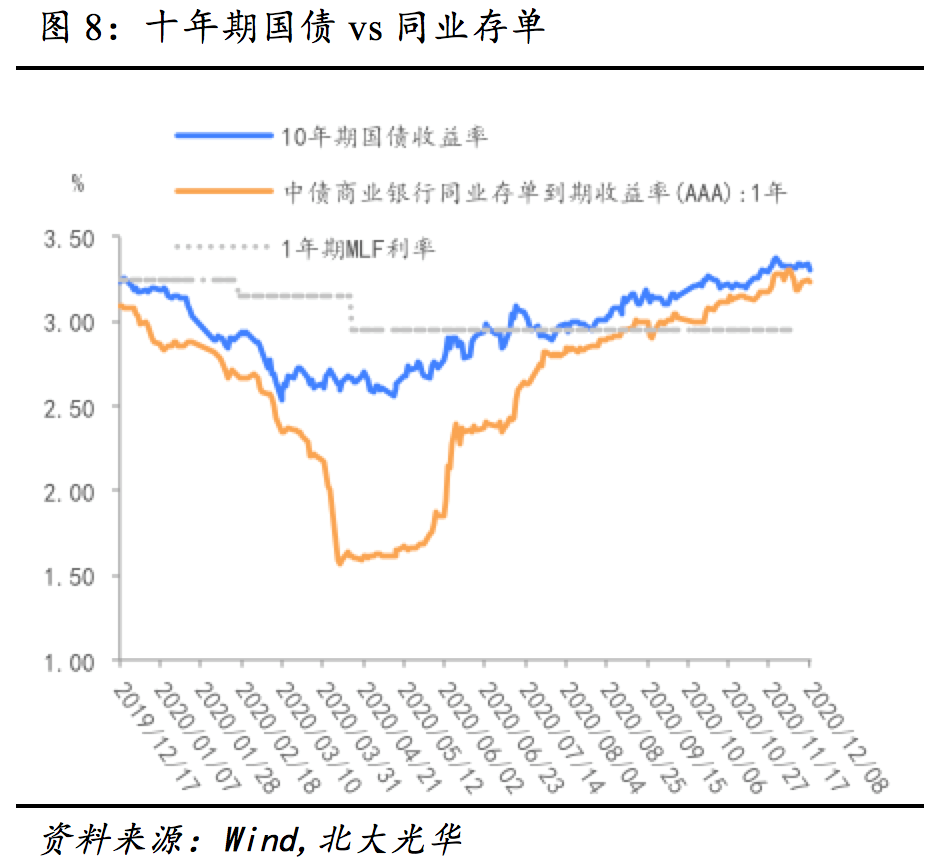

Third,more efforts should be made to observe the effect of long-term interest rate on the credit market and strengthen the central role of medium-term lending facility(MLF).Following defaults by several local state-owned enterprises,the interest rates of interbank deposits and ten-year government bond continued to increase,which means that such default cases have already affected overall liquidity and the rate securities market. If monetary policy is tightened now,firms will have greater difficulties in financing and thus prone to default. Currently the main effect of policy interest rate is largely reflected in reverse repo and has notable guiding effect on short-term interest rate. Meanwhile,the role of MLF,mostly in guiding loan prime rate(LPR),is relatively weak. The effect of MLF on ten-year government bond is relatively thin while the interest rates of interbank deposits and ten-year government bond have strayed far from policy interest rate. The central bank should focus more on the transmissive effect of policy interest rate on ten-year government bond,with efforts to boost the transmission efficiency of monetary policy by influencing long-term interest rate.

chart 7: Lower income growth holds back consumption

chart 8: ten-year government bond versus interbank deposits

Therefore,it is our opinion that monetary policy for 2021 should continue to focus on high-precision adjustment and control,with key policy support for weak areas in key fields. Currently China’s economic recovery is not even. Monetary policy should offer long-term support for downstream industries,small- and micro-sized firms and labor-intense firms in employment and fund relief. Loan and cash support should also continue for these businesses.

Fiscal policy in 2021 should be moderate and avoid abrupt turns. First,as fiscal policy goes back to normal,budgetary funds will be slightly smaller than last year.However,as expenditures in outbreak control,public health and people's livelihoods are indispensable,the overall budget will not decline too much.Second,budget deficit should be maintained at a level around 3 percent.As China's leverage ratio problem is not as notable as other countries,an increase in deficit is still acceptable amid economic recovery.Third,the special bonds quota should be kept stable and close to the 2020 level. Despite excessive increase last year,some of it was not fulfilled.While the quota should be reduced this year,2021 is the first year of the country's 14th five-year development period and the quota should not shrink too much to ensure abundant funds for investments.Fourth,while various tax relief policies made to cope with Covid-19 impact should be rolled back,fiscal spending within the central budget should be further reduced to ensure benefits for people’s livelihoods,with other non-tax fee reduction policies still in place.

4.Explore new development patterns,and overcome chokepoint challenges.

This year marks the start of China's 14th five-year development period and a new path to basically realize socialist modernization.In order to realize the long-term goals set for 2035,the country has to overcome a series of challenges in its social and economic development. These are:

a. As China’s industrialization is wrapped up,how can it maintain an annual total factor productivity(TFP)growth of 2.5 to 3 percent(currently around 2 percent)?

b. How can China climb higher along the global value chain and achieve a relatively closed loop in industrial chain and supply chain?

c. How to increase the share of consumption in GDP so as to make the country's domestic market the mainstay in a new development pattern? How to improve the consumption structure(increase the share of service consumption)?

d. How to cope with the profound,ongoing changes in the country's industrial and work force structures?

e. How to cope with the profound changes in China's income distribution structure in the upcoming years?

f. How to effectively push forward urbanization?

g. How to boost return on capital?

h. How to boost research and development efficiency?

5.Achieve high-quality development,ready for multi-pronged reform measures

Greater reform and innovation efforts are needed to overcome the above-mentioned structural challenges. In 2021,exciting reform measures might be carried out in a wide spectrum of fields.

Efforts will be made to reform of the household registration system,improve the market of land for construction by integrating urban and rural regions,ensure the free flow of work force and the circulation of land for rural construction,and accelerate the urban resettlement of work force from rural areas.Urban residency restrictions must be further relaxed as part of deepened household registration system. Measures to revive rural areas must be conducted in line with urbanization to reduce the urban-rural gap. Collectively owned rural land for construction use will be freely circulated,and rural residents property income will increase.

Greater efforts to develop for-rental housing is a key reform measure for the creation of a domestic market as the mainstay for the country's development.First,effective supplies of for-rental housing could be boosted by expanding land sources for such houses,increasing new land supplies and re-using existing houses. Second,expand sources for construction funds to encompass housing provident fund,government spending and social capitals such as REITs. Third,allow more market entities to participate in the construction and operation. Fourth,diversify for-rental housing products to meet demand. Fifth,tax and loan support for related firms to encourage their participations.

A series of reform measures for innovation in science and technology.According to a document of development proposals for the 14th five-year plan,China willintensify its national strategic strength in science and technology,focus on core technologies and improve the overall efficiency of the innovation chain. Greater input is needed to boost S&D intensity and improve S&D structure, with a special focus on basic science and underlying technologies. Meanwhile, efforts should be made to enhance China's capacities to independently control its industrial chain and supply chain. 2021 will be a year for science and technology innovation, with capital, S&D input and talents pooled into fields of national strategic importance.

In terms of reform of the capital market,one focus will be to increase the proportion of direct financing and boost the quality of listed companies.In addition to removing obstacles in both entry and exit,listed companies must be pushed to improve corporate governance,information disclosure and transparency.Another focus will be to strengthen the legal construction for the bond market to prevent systemic risks.Defaults by some local state-owned enterprises shook the market last year. In 2021,China's financial system will become more market-based,professional and international with further supply-side reform,and solid progress will be made in the market-based pricing of financial assets.

China's national strategies will be combined more effectively with the market,with unwavering efforts to accelerate industrial structure upgrade. The year 2021 will see many changes and opportunities hidden behind these changes,including the construction and industrial integration of 5G as well as the rising of consumption-related industries.

The benefits and advantages of big Chinese cities will be spread outward via the construction of metropolitan areas around them,andthe country will aim to achieve higher urbanization efficiency and regional development equality. There will be exciting breakthroughs in the theoretic discussions and real-life progress in urbanization.

Programs

Programs