China’s National Bureau of Statistics released a set of economic data for the second quarter earlier this week amid complex, austere domestic and overseas situations. The macroeconomy research team under the Thought Leadership project of Peking University's Guanghua School of Management has offered their interpretations.

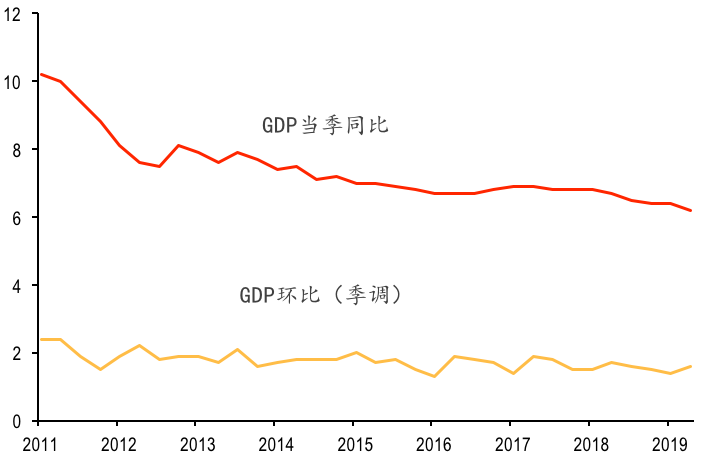

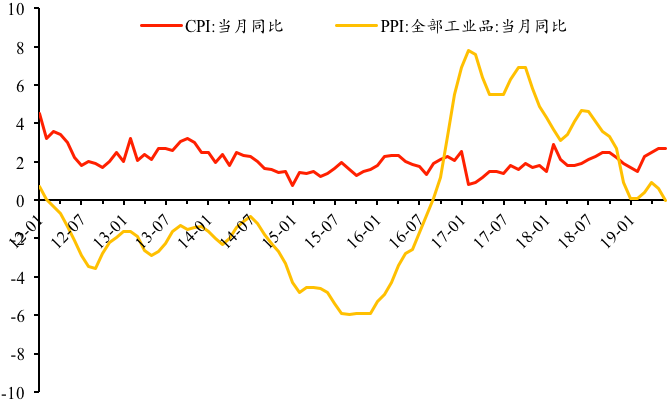

The country’s economy still faces downward pressure, but there are also signs of bottoming out. China GDP saw a year-on-year increase of 6.2 percent in the second quarter, lower than the 6.4 precent in the first quarter. The economy is still slowing down as GDP for the first half of 2019 rose by 6.3 percent. Meanwhile, PPI fell to near-deflation level, increasing the pressure of economic downturn. This was mainly the result of global economic slowdown and external demand restrained by the China-US trade dispute. Other factors included domestic real estate investment limits, languid investment on infrastructure and unsustainable consumption growth. However, data improved in June. As fiscal policy addresses local government debts in the later half, counter cyclical monetary policy adjust takes effect, and China-US relations improve and stabilize market expectations, the economy will gradually bottom out. Therefore, it is our opinion that China’s economy might bottom out in the fourth quarter and begin gradual upswing at the end of the year.

GDP FURTHER SLOWS, PPI NEARS DEFLATION LEVEL

China GDP saw a year-on-year increase of 6.2 percent in the second quarter, signaling economic downturn. PPI in June saw zero growth, a month-on-month decline of 0.6 percentage points, almost reaching deflation level. This is mainly the result of falling oil prices and weak internal and external demand. Also, PPI in June 2018 rose 4.7 percent year-on-year, a relatively low base number. Once the economy enters deflation, it will be hard to reverse the trend in near future. Consequently, the economy is likely to keep slowing down. However, GDP growth in the second quarter rose by 1.6 percent from the first quarter, up from the previous 1.4 percent. June data was also better than forecasted. The economy is likely to bottom out soon.

INTERNAL, EXTERNAL DEMAND UNDER RESTRAINT

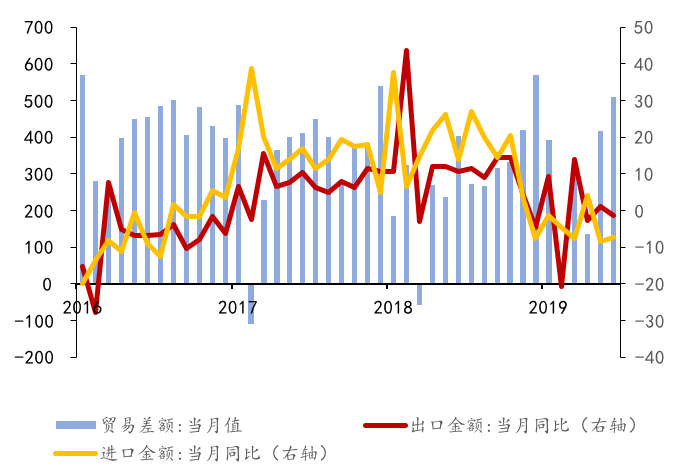

From a global point of view, economic slowdown and China-US trade dispute are increasingly pressuring external demand. China’s exports in June fell by 1.3 percent year-on-year, down 2.4 percentage points from May, and less companies are rushing their exports in fear of future uncertainties. Meanwhile, imports fell 7.3 percent from a year earlier, not as bad as the 8.5 percent decrease in May but still continuing a contraction trend, reflecting the risk of declining internal demand. While trade surplus widened, growth slowed.

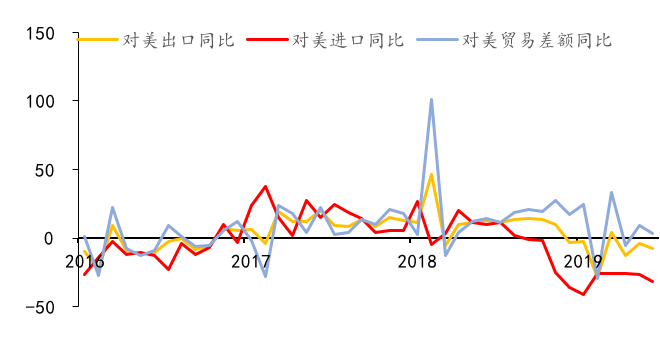

Dragged down by the China-US trade dispute, China’s exports to and imports from the U.S. both fell. As less export orders are rushed in fear of future uncertainties, hiked tariffs will start to take effect. With long-term and complicated negotiations, impact from the trade dispute will linger in the later half.

LACKLUSTER INVESTMENT, UNSUSTAINABLE CONSUMPTION

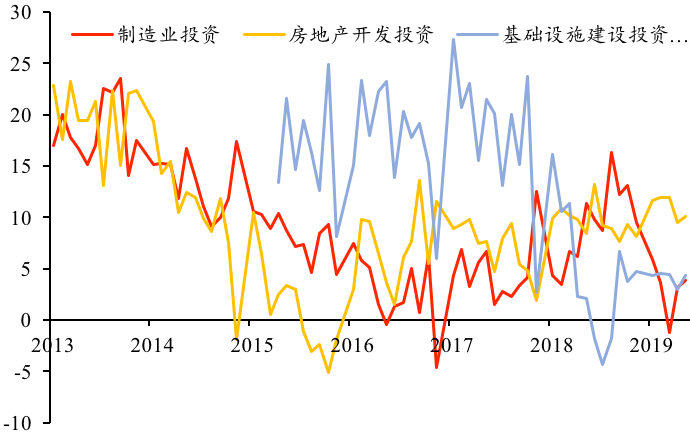

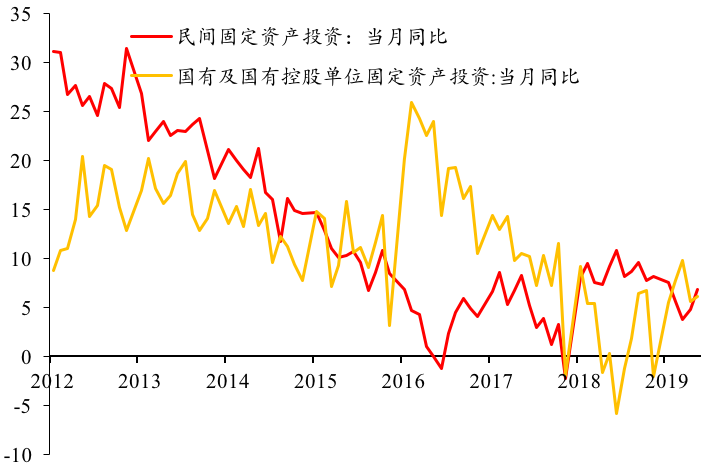

Real estate market is still under relatively strict policy control. Real estate investment rose slightly in June, but house sales fell by 2.3 percent and continued negative growth. Meanwhile, infrastructure investment was worse than expected as a result of local debts. Due to large volumes of local debts, the central government tightened policy to prevent risks, which, to a large extent, held back the progress of infrastructure investment. On the other hand, private investment improved, rose 5.7 percent between Jan. and June from a year earlier, up 0.4 percentage points from the Jan.-May period. Investment from state-owned enterprises between Jan. and June rose 6.9 percent, down 0.3 percentage points from the previous period.

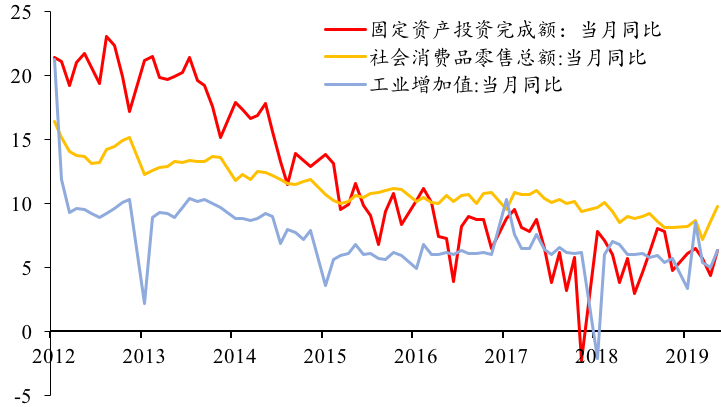

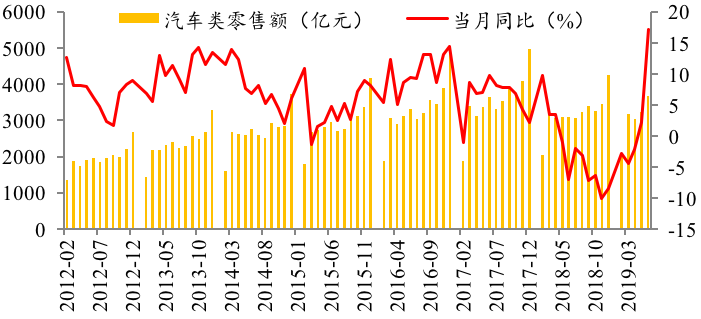

China’s value-added industrial output rose 6.3 percent in June from a year earlier, accelerating from the 5.0 percent in May and better than market forecast. This is due to a low base number from last year as well as better-than-expected growth of mining and other industries. Boosted by car sales mainly, retail sales of consumer goods grew 9.8 percent in June from a year earlier, compared with the 8.6 percent from the previous month. Huge promotion of vehicles before new emission standards took effect on July 1 boosted overall consumption in June, but its effect was only temporary, and future consumption trends should be closely watched.

EYES ON DOMESTIC POLICY, CHINA-US RELATIONS

While the economy is still facing downward pressure in general, sound data in June signaled an upcoming, gradual process of bottoming out. New policy tools are expected to support the economy in the later half. Fiscal policy will continue to play a key role in stimulating the economy, including adjustment of local debts through counter cyclical monetary policy. Currently there is still 1.2 trillion yuan (174.4 billion U.S. dollars) left in the local government debt quota, and the quota can still be raised if necessary. Consequently, infrastructure investment still has potential for growth. Meanwhile, counter cyclical monetary policy might further boost market mobility to ensure flexibility in a controlled, precise manner. It is also hoped that China-U.S. relations will improve in the future so as to stabilize and positively guide the market. Therefore, it is our opinion that China’s economy is likely to bottom out by the year end.

In 2017, Guanghua launched the Though Leadership Platform, with the mission to promote research addressing critical and structural problems in public policy and frontier business practices in China and contribute to industrial and national development. Systematically and elaborately planned by the Guanghua faculty, the program also makes use of the platform's key research achievements.

Programs

Programs