Source: Economic and Political Studies

Keywords: International contracts; China; Latin America and the Caribbean; natural resources; globalisation

Abstract

As China’s economy has reached the stage of ‘New Normal’, Chinese companies are increasingly seeking opportunities overseas. In the context of the slow recovery of world economy, China’s outward economic activities have found themselves in many parts of the globe, including the Latin America and the Caribbean (LAC) region, some of the farthest places away from China. While many scholars have conducted extensive studies on China’s trade and foreign direct investment (FDI) in Latin America and the Caribbean, this paper focusses on Chinese contracts in the region, a topic that has been rarely studied. Using both random-effects and fixed-effects models covering 30 LAC economies during 1998–2015, the multivariate panel regressions show that among numerous determinants, Chinese companies prefer to undertake projects in the countries that are economically more advanced and more populous. In addition to the level of development and the size of population, those that have natural resources, expansionary economy, and political openness tend to have Chinese contracts completed. The above, however, is true of only the countries with which China has diplomatic relations. For the countries that recognise China’s Taiwan ‘diplomatically’, Chinese contracts do not seem to be as much economically determined as those that recognise People’s Republic of China (PRC) diplomatically. Politics appear to interfere with contractual decisions except in the following categories: mineral resources and an expansionary economy.

Introduction

After maintaining a fast economic growth for 35 years, China has now entered a new developmental stage named‘New Normal’, which means that the country accepts a slower pace of economic growth but focusses on upgrading the economic structure, while transitioning from its investment-and-export intensive expansion to a consumption-led growth model (Hu 2015). In this context, ‘China going global’ has become anational developmental strategy. The trend of China’s firms investing in other economies has intensified in recent years, particularly since the 18th Congress of the Communist Party of China (CPC) in 2012, with China’s economy officially entering a phase of ‘New Normal’. In this paper, our focus is on Chinese mainland contracts (hereafter‘Chinese contracts’) in the Latin America and the Caribbean (LAC) region. Although China and LAC countries are far apart from a geographic perspective, the complementary nature of their economies and broadly shared interests lead to a rapid increase in economic activities between them. LAC countries are abundant in natural resources that are indispensable for China’s long-term economic growth. For example, Brazil holds the world’s third largest reserves of crude iron ore and nickel (United States Geological Survey 2015, 2017b). Venezuela has the world’s largest proved reserves of crude oil (United States Energy Information Administration 2016). The known deposit of copper in Chile takes nearly 1/3 of the world’s total reserves (United States Geological Survey 2017a). Peru ranks first and third in silver and copper reserves, respectively (United States Geological Survey 2017a, 2017c). Because of the strategic importance of the above resources, it is crucial for China to strengthen its economic ties with LAC countries to diversify its resource supplies, particularly considering the territorial disputes it has with some of the Asian countries.

Furthermore, one of the most fundamental impediments for economic growth among LAC countries is their weak infrastructure, particularly with respect to transportation. In many Latin American economies, 91% of transportation and logistics rely on road services (Wu 2014). However, the quality of roads in many parts of Latin America is far below the international standard, substantially reducing the efficiency of the economy (Wu 2014). In order to improve the infrastructure and build a physical foundation for economic growth, the governments of several Latin American countries (e.g. Brazil, Mexico, Colombia, and Chile) have put forward massive infrastructure construction plans (Wu 2014). Since many Chinese firms have accumulated much experience in building infrastructure during the past 30 years, they find themselves useful in infrastructure projects in the LAC region.

Also, because of historical and geographic reasons, LAC has been under the influence of the United States in terms of politics, economy, and culture. Some of the LAC economies have been trying to reduce such influence in response to short-term domestic political pressures and long-term interests in revitalising the national identity. In addition, some LAC countries have been averse to the political and economic conditions imposed by the United States and other western economies when receiving foreign aid. Under these circumstances, enhancement of economic cooperation with China has become an attractive option, due to the Chinese government's official policy and position of non-interference in the domestic politics of other countries.

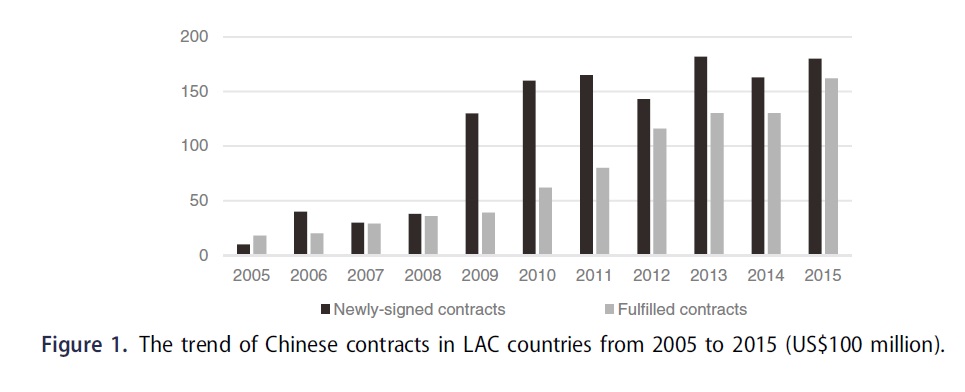

Since Chinese President Xi Jinping's first state visit to Trinidad and Tobago, Costa Rica, and Mexico in June 2013, the surging bilateral economic cooperation between China and LAC countries has become one of the most featured highlights in world economy (Xinhua Net 2013). In 2013, the total volume of China-LAC trade increased by 24 times compared with 2000 (Gonzalez 2015). China has established Free Trade Agreements (FTAs) with Chile, Costa Rica, and Peru; it is expected to expand the network of FTAs to other LAC economies (China FTA Network 2017). In 2014, China became the top destination of exports from Brazil, Chile,Peru,and Uruguay (The Atlas of Economic Complexity 2014). With regard to foreign direct investment (FDI), Chinese companies invested US$4.6 billion in greenfield FDI (GFDI) and US$49.9 million in mergers and acquisitions (M&A) in LAC in 2015 (Ray, Gallagher, and Sarmiento 2016). Subsequently, China has become the second largest source of GFDI after the United States, and the third largest source of FDI through M&A following the United States and Spain (Ray, Gallagher, and Sarmiento 2016). Apart from trade and FDI, China has substantially increased its lending to LAC countries. According to the Chinese Finance to LAC in 2015 Report published by the Inter-America Dialogue, China’s lending to LAC nearly tripled in 2015 (Myers, Gallagher, and Yuan 2016). The report indicates that the China Development Bank (CDB) and China ExportImport Bank (Eximbank) provided US$29 billion to LAC countries in 2015, an increase of US$19 billion compared with 2014 (Myers, Gallagher, and Yuan 2016). Chinese contracts in the LAC region, which are the focus of our paper, have experienced a salient increase in recent years. According to the Ministry of Commerce of China, the volume of newly-signed contracts between China and LAC economies reached US$18.16 billion in 2015, increasing by 10.3% over 2014 (Ministry of Commerce of China 2016). The volume of contracts that were fulfilled climbed to US$16.4 billion, achieving a 24.4% increase over 2014 (Ministry of Commerce of China 2016). Figure 1 shows the trend of Chinese contracts (both agreed and fulfilled contracts) in LAC countries from 2005 to 2015.

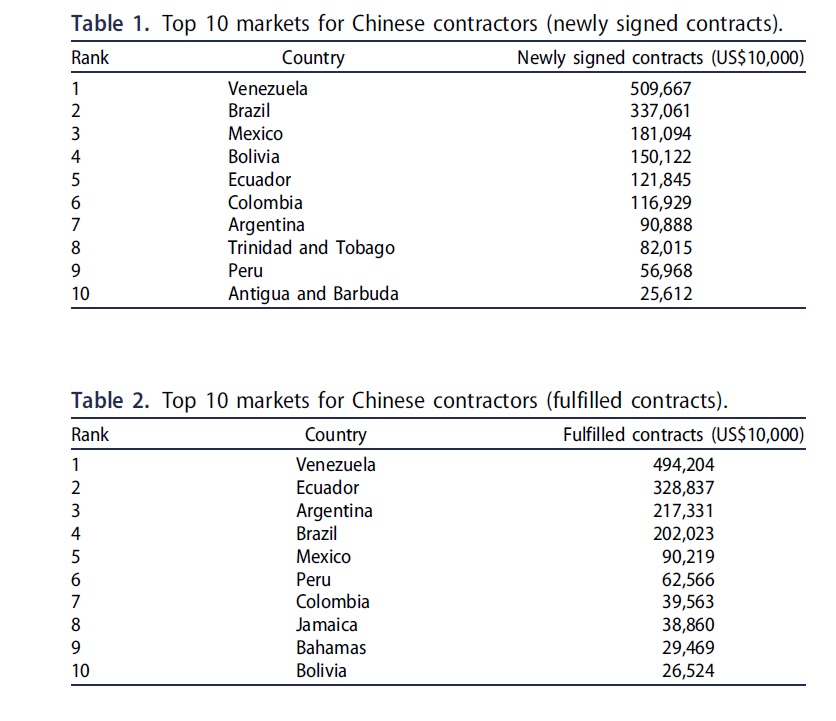

It is noticeable that Chinese contracts are concentrated in those countries abundant in natural resources and with a high demand for infrastructure. For example, Venezuela took 40% of total volume of China's newly signed contracts and fulfilled contracts in the whole region in 2015 (China International Contractors Association 2016). Besides, the newly signed contracts in Brazil, Mexico, and Colombia also doubled compared with 2014 (China International Contractors Association 2016). Tables 1 and 2 show Chinese contractors' top 10 markets in the LAC region in 2015 in the categories of newly-signed contracts and fulfilled contracts.3 In terms of sectors, the newly-signed contracts associated with electronic-engineering projects surged by 30% compared with 2014 (China International Contractors Association 2016). Since LAC boasts rich power resources and Chinese contractors possess construction expertise, Chinese contractors have been involved in various construction projects of hydro power stations in the region.

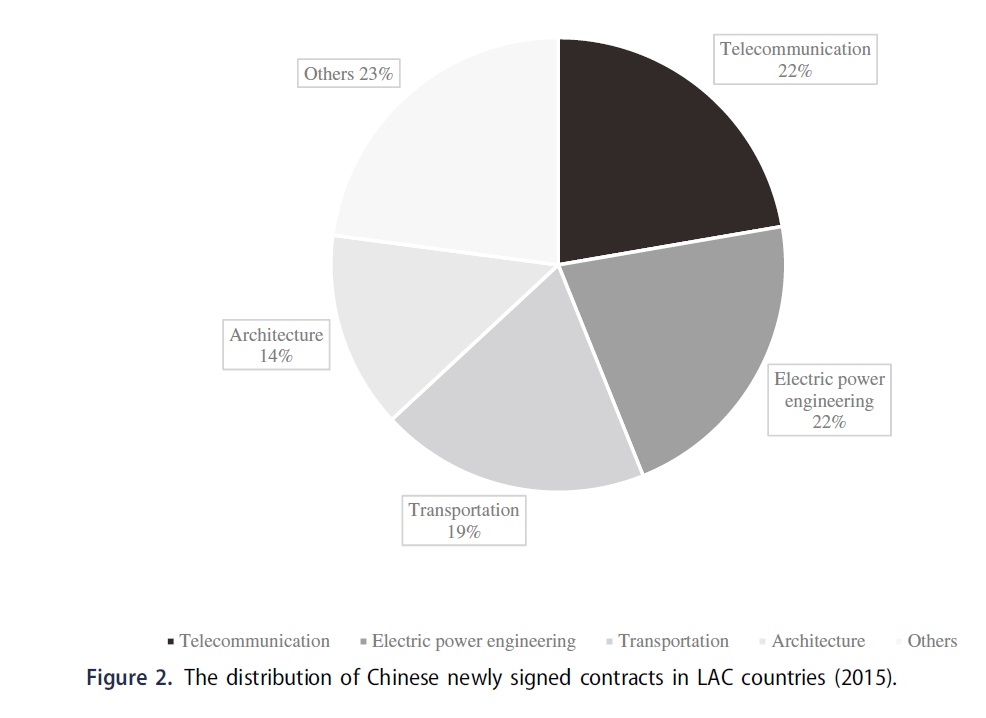

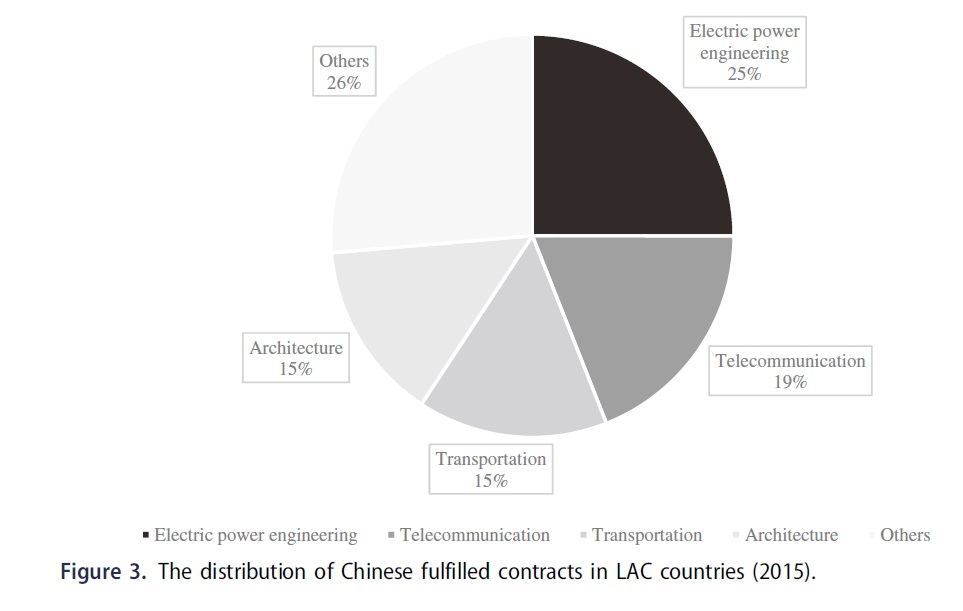

In 2015, China National Nuclear Corporation (CNNC) reached an agreement with Argentina Nuclear Power Company to build a fourth nuclear power plant in Atucha (Anderlini and Rathbone 2015). CDB will provide 85% of the financing with a 6.5% interest rate for this US$6 billion project and CNNC will supply 38% of the equipment (Anderlini and Rathbone 2015). Other sectors such as telecommunication, architecture, and petrochemical engineering also saw large increases in terms of both newly-signed and fulfilled contracts in 2015 (China International Contractors Association 2016). Figures 2 and 3 list the major fields of Chinese contracts in LAC countries in 2015.

Despite the brisk activities of Chinese contractors in LAC, however, challenges exist that could impede further development of bilateral cooperation. For example, political dynamics in some LAC countries could lead to unilateral breach of the signed contract. Besides, a low standard of governance and high transaction costs could substantially reduce efficiency in the execution of contracted projects in some economies. Furthermore, vocal and well-networked environmental groups and communities challenge the planning and implementation of the projects that have negative or potentially negative implications for the natural habitat. All these factors impose tough challenges for Chinese companies to expand their contracted projects to the next level. The rest of this paper is organised as follows: the next section discusses a theoretical framework for our study and elaborates on the variables we will use in our hypothesis testing. The subsequent section presents our panel regression model and analyses the empirical results. The last section draws concluding remarks.

Theoretical framework, model specification, and data

International contracts by themselves are rarely studied theoretically or empirically. A closely related field of investigation is FDI. Despite the differences between international contracts and FDI, which are largely centred on the ownership of the project, they share the rationale in the theoretical domain.5 For example, the eclectic theory of FDI (Dunning 1977, 1979) is a major milestone in the theories of FDI, with an emphasis on locations while incorporating arguments on both firm-specific characteristics and internalisation. In the eclectic theory of FDI, three conditions will be propitious for FDI: the ownership advantage (monopoly, technology, and economies of scale), the location advantage, which has implications for all those relevant factors in the host country related to production, including cultural, economic, social, and political dimensions, and finally, the internalisation advantage which entails the production and integration of various intermediate products. Another milestone is the classification of FDI on the basis of investors’ objectives: market seeking, resource seeking, efficiency seeking, and strategic asset seeking (Dunning 1993). The aim of market-seeking FDI is to benefit from an expanded base of consumers through the production and sales of an existing product overseas, which may result in altering the product to conform to the tastes of local customers. The objective of resource-seeking FDI is to establish an ownership presence abroad to obtain resources not available in the home country. Such resources may include natural resources (for instance, petroleum, natural gas, and minerals), low-cost labour and capacity of technology and management. Efficiency-seeking FDI benefits from the efficient use of certain factors in foreign economy and results from the ‘economies of scales and difference in consumer tastes and supply capabilities’ (Dunning 1993, 60). Finally, strategic asset-seeking FDI is to acquire technology for strategic purposes in other economies. In this theoretical framework of the four kinds of FDI, the first two – market seeking and resource seeking – are particularly relevant to Chinese contractors. It is very likely that Chinese contractors go to Latin American countries with a large population or a large economy to seek and consolidate their market base for future growth of their contractual business. In this sense, theoretically we should find Chinese contractors more likely in large economies and/or populous societies. They may also want to take advantage of the natural resources in Latin America, particularly when Chinese economy increasingly depends on natural resources. In terms of efficiency seeking, Chinese contractors tend to bring their own technicians and very often their construction workers to foreign sites, the efficiency-seeking criterion may not be an important consideration. As to strategic asset seeking, unless the Chinese develop an ownership of the project, the long-term strategic reorientation of the business is not quite relevant. Given this theoretical framework, we look for the determinants for Chinese contractors particularly in terms of the marketing-seeking and resource-seeking criteria. In addition, we also look at the domestic political and economic conditions under the rubric of the location advantage associated with the eclectic theory of FDI.

Previous scholars have conducted extensive studies on the determinants of Chinese FDI overseas (for example, Taylor 2002; Deng 2004; Buckley et al. 2007; Kolstad and Wiig 2012). However, to our knowledge, there has not been a systematic study regarding the characteristics and determinants of Chinese overseas contracts in LAC economies.

In the following empirical section of our study, the dependent variables in our panel regression model are, respectively, the value of agreed contracted projects and the value of fulfilled contracted projects. The data for these two variables are obtained from the China External Economic Statistical Yearbook (National Bureau of Statistics of China 1999–2016) and the China Statistical Yearbook (National Bureau of Statistics of China 1999–2016). With respect to the independent variables, we classify them into four categories of determinants: macroeconomics, political systems, resources, and foreign relatios.

Macroeconomic factors

Level of development

Regarding the impact of macroeconomic factors on Chinese outward FDI, previous scholars chose to use the size of economy measured by overall GDP as a proxy for the market (Globerman and Shapiro 2002; Eichengreen and Tong 2007; Kolstad and Wiig 2012). If a country has a weak economic foundation, it will have a more urgent need for foreign capital due to its insufficient domestic capital. In addition, one of the most important causes of the lagging economic development is the lack of infrastructure, such as roads, railways, and ports. Since Chinese companies have expertise in infrastructure construction, the demand from those weak economies would attract Chinese companies to explore their under-developed markets. However, we need to note that countries that have more advanced economic foundation would also attract foreign capital because of their efficient institutions and stable business environment. For example, Brazil, Argentina, Peru, and Chile are considered relatively rich countries in LAC countries in terms of GDP, and these four countries are the main contract partners of Chinese companies. Buckley et al. (2007) find that the absolute market size has a positive effect on Chinese outward FDI, with 1% increase of GDP raising Chinese outward FDI by 0.35%. Furthermore, recent studies conclude that market seeking is a key motive for Chinese companies to invest abroad (Zhang and Markusen 1999; Taylor 2002; Deng 2004). Feng, Jiang and Yu (2015) find that the real GDP per capita has a positive effect on Chinese contracts in Africa based on a multivariate regression covering 53 countries from 2000 to 2010. Similar to their work, we use GDP per capita as a proxy for the level of economic development. In the case of LAC, we believe that the scenario of a positive effect is more plausible between the two opposite effects of the economic size on contracts, as the poor economies may not be able to afford them, keeping other factors constant. Therefore, we expect the effect of the level of development on Chinese contracts to be positive.

Population

In general, a large population creates a high demand for transportation, telecommunication, power plants, and various types of services. As shown in Figures 2 and 3, these areas are the focus of Chinese contractors due to the match with their expertise. Therefore, Chinese companies tend to make investments or undertake contracted projects in countries with a large population, such as Brazil and Argentina, keeping other factors constant. In recent years, there has been an increasing trend that Chinese companies are advancing their localisation strategies (Wang 2017). A populous country implies relative labour endowment. Chinese companies begin to hire more local workers to participate in construction. The training programme carried out in the later stage of the contracted project functions as a form of transfer of knowledge and technology. In this way, Chinese companies are gradually integrating themselves into local communities (Wang 2017). Moreover, since China has the largest population in the world, the experience gained during the country’s massive industrialisation and urbanisation has provided Chinese contractors with a unique advantage in undertaking construction projects in densely populated areas in the LAC region. We expect a positive effect of population on Chinese contracts.

Investment

Previously scholars explored whether the foreign capital had a ‘crowding-in’ or ‘crowding-out’ effect on domestic investment from different perspectives or vice versa. For example, Agosin and Machado (2005) identify a ‘crowding-out’ effect of domestic investment by FDI based on a panel regression model covering 12 economies in each of the three developing regions (Asia, Africa, and Latin America) from 1971 to 2000. Alternatively, the level of domestic investment may be an indicator for business environment. Those countries with relatively high levels of domestic investment may signal a benign market that encourages investment, therefore, attracting international capital and contracts. We use the gross capital formation as a percentage of GDP as a proxy for the investment and expect an ambiguous effect due to the contrasting possibilities mentioned above.

Economic openness

In our model, economic openness is measured by the sum of exports and imports of goods and services as a share of GDP. Since the level of trade is an important indicator of a country’s level of economic openness, a country that has a large share of trade in its GDP demonstrates a positive attitude toward economic cooperation with foreign countries. In an open economy, the government typically sets few restrictions on FDI and contracts, providing an encouraging atmosphere for Chinese contractors to undertake projects there. However, the above reasoning is inconsistent with some studies of Chinese outward FDI. For example, Kolstad and Wiig (2012) find a negative but insignificant impact of trade on Chinese outward FDI using a multivariate regression model covering 104 countries during 2003–2006. Buckley et al. (2007) identify a similar result. In contrast to these two studies, Feng, Jiang and Yu (2015) discover that trade has a positive impact on Chinese contracts in Africa. In our model, we use two variables to capture the effect of openness: openness referring to the sum of exports and imports of goods and services as a share of GDP, and trade measured by the host country’s trade (importsþexports) with PRC. We expect that both have a positive effect on Chinese contracts.

Inflation

From a practical perspective, inflation implies a depreciation of profits earned by companies. As a result, companies would not choose to invest or undertake projects in a country with high inflation. However, if the value of contracts is denominated in some international currencies (e.g. US dollars and Euros), the inflation in the host country should not significantly affect the profit of Chinese contractors. Besides, from the Keynesian school’s perspective, if the government or central bank implements expansionary macroeconomic policies in order to boost economic growth, it is likely to incur inflation, but an expansionary economy will generate a higher demand for Chinese investments or contracts. Buckley et al. (2007) find a positive and significant impact of inflation on Chinese outward FDI. Similarly, Feng, Jiang and Yu (2015) discern a positive effect of inflation on Chinese contracts in Africa. We expect positive impact of inflation on Chinese contracts in LAC economies.

Private credit

Private credit is measured through the ratio of private credit to GDP.6 It indicates the strength of credit market in an economy. Credit is directly related to trustworthiness and therefore, this variable also signals institutional quality of a country and is an index of the business environment of the host country. Following He et al. (2016), we use this variable as an indicator of institutional quality and the relative degree of private lending in a country. We expect the private credit variable to take a positive sign. The source of this variable is the World Development Indicators (World Bank). One country, Cuba, has missing values for the entire series, and two others, Barbados and Venezuela do not have complete data for this variable. We will first run regression without this variable and then add this variable in a subsequent sensitivity test.7

Political factors

Governance

Several scholars analysed the impact of political institutions on foreign capital (Schneider and Frey 1985; Enders and Sandler 1996; Tuman and Emmert 2004; Egger and Winner 2005; Daude and Stein 2007; Asiedu and Lien 2011). Schneider and Frey (1985) use a politico-economic forecasting model which simultaneously includes political and economic variables to analyse their impact on attracting FDI, and they predict that political instability will significantly reduce the inflow of FDI. Such prediction was confirmed by the ex post prediction for 1980 on the basis of the estimation of a politico-economic model for 1979. Busse and Hefeker (2007) conclude that government stability, internal and external conflicts, law and order, bureaucratic quality, reduction in corruption, and democratic accountability are significant factors in attracting FDI based on a sample of 83 developing economies from 1983 to 2003. They apply the Arellano-Bond GMM dynamic estimators in order to address the autocorrelation and endogeneity in a time-series analysis. In contrast to the above findings, Buckley et al. (2007) conclude that Chinese investors choose target countries that have low level of democracy and governance, which could be attributed to difficulties of those countries to attract capital from western economies and international organisations. In addition, Buckley et al. (2007) surmise that the similarity of certain governance features between those countries and China could induce Chinese investments because of institutional similarities between China and the host countries. This assumption is reinforced by Dixit (2011) who finds firms that have experience of coping with poor governance in their home country have some advantages when making investments in a country with similar governance framework. This finding helps to explain the increase in the flows of FDI among developing economies.

We use the Worldwide Governance Indicators (WGI) as a measure for the quality of governance of each LAC country. The WGI consists of six components: voice and accountability, political stability and absence of violence/terrorism, government effectiveness, regulatory quality, rule of law, and control of corruption (Kaufmann and Kraay 2016). In our study, we integrate the six components of WGI into one variable by conducting principal component analysis (PCA) due to the multicollinearity problem when including all the six components in regression. Given conflicting findings of existing studies and various patterns of Chinese contractors across the LAC region, we hold an uncertain view regarding the impact of governance on Chinese companies’ contracts in this area.

Political rights

In order to further measure the effect of the political system on Chinese contractors, we use the variable of political rights from Freedom House. According to Freedom House, the range of political rights is from 1 to 7. The lower the score, the freer the country is (Freedom House 2016). Those countries with a score of 1 in terms of political rights are defined as ‘most free’, since they have free and fair elections as well as checks and balance systems (Freedom House 2016). If a country receives a score of 6 or 7, it is considered ‘unfree’ for it is ruled by a dictator or a single party (Freedom House 2016). Countries in between are defined as ‘partly free’. A

ccording to Olson (1993), democracies have more advantages in attracting foreign capital than authoritarian countries because the former are more restrained by the constitution than the latter and are not able to infringe upon property rights (Olson 1993) as much as the latter do. Jensen (2003) conducts an empirical study to assess the effect of political conditions on attracting FDI using both cross-section and panel regression analysis for 114 countries. The empirical results in both models show that democratic governments, even when controlling for other economic and political factors, attract 70% more FDI as a percentage of GDP than authoritarian governments. However, Feng, Jiang and Yu (2015) find that political rights have a negative effect on Chinese contracts in Africa, which is consistent with the assumption of ‘familiarity of institutions’ (Buckley et al. 2007). In our analysis, we adopt the original scale with 1 representing the most free and 7 the least free; therefore, a negative sign on this variable in the regression or correlations means a positive relationship between political rights and other variables. Similar to governance, we expect an ambiguous effect of political rights on Chinese contracts in the LAC region.

Resource factors

As China is in the process of massive urbanisation, cities need to improve their infrastructure to satisfy the demand of surging migrant population. Oil supply, an essential element for the construction of infrastructure, holds strategic significance for the next development stage of Chinese economy. According to the World Energy Outlook,China switched from an oil-exporting country to an oil-importing country in 1993, and its demand for oil is expected to surpass that of the United States in 2020 (International Energy Agency 2013). Furthermore, due to territorial disputes between China and some Southeast Asian countries, the safe passage of oil shipping through Malacca Strait may become a challenge in the future. Therefore, China needs to make a lot of efforts to diversify its sources of oil supply to ensure availability of energy support for economic growth (International Energy Agency 2013). The abundant oil reserves in some LAC economies, such as Venezuela, Brazil, and Ecuador, provide attractive options for China’s energy-diversification strategy.

An essential dimension of the eclectic theory is the internalisation advantage that emphasises the importance of equity-based control when investing in energy industries (Dunning 1973). This has been illustrated by a large amount of Chinese investments and contracts in energy industries overseas. Buckley et al. (2007) find a positive relationship between the endowment of natural resources (measured by the ratio of ore and metal exports to merchandise exports) of the host country and Chinese outward FDI. Feng, Jiang and Yu (2015) conclude that the resource-based model is the most promising one to explain determinants of Chinese contracts in Africa compared to the macroeconomic and political models. Kolstad and Wiig (2012) discover nuanced empirical results by constructing an interactive term of natural resources and quality of institutions. They conclude that countries with poor institutions but abundant in natural resources attract more Chinese FDI. Asiedu and Lien (2011) find that democracy promotes FDI only if the share of oil and minerals in total exports of the host country is less than some critical values. We use two variables to proxy the resource factors: oil rent and mineral rent as a percentage of GDP. We expect a positive sign on both oil rent and mineral rent.

Diplomatic factors

Taiwan of China

In our sample, nine LAC countries have ‘diplomatic relations’ with Chinese Taiwan. For them, their economic relations with Chinese mainland have been substantially complicated by the rivalry between Chinese mainland and Chinese Taiwan (Avenda~no and Dayton-Johnson 2016). Taiwan of China has negotiated bilateral FTAs with Panama (2004), Guatemala (2006), and Nicaragua (2008) to further their economic cooperation (Avenda~no and Dayton-Johnson 2016). Consequently, Chinese mainland firms’ bidding for the improvement of the Panama Canal suffered an impasse despite contracts signed between PRC and Panama over the years (Avenda~no and Dayton-Johnson 2016).8 In addition, according to World Integrated Trade Solutions (WITS) Comtrade and Taiwan Bureau of Foreign Trade, Central American exports to Chinese Taiwan exceeded those to Chinese mainland for most of those countries during 2001–2012 (Taiwan Bureau of Foreign Trade 2013; WITS 2013). Among them, exports from Salvador and Nicaragua to Chinese Taiwan were nearly five times as large as those to Chinese mainland in 2012 (Avenda~no and DaytonJohnson 2016). We expect a negative effect of the Chinese Taiwan factor (Chinese Taiwan is a variable name in the regression; it stands for Taiwan of China) on Chinese contracts in LAC economies and that the variable Chinese Taiwan takes a negative sign in the regression analysis.

Other contextual factors

Culture, language, and geographic distance are also reasonable considerations as determinants of contracts. However, in the case of Latin America, culture and language are almost constant, as a result of shared cultural heritage and language. With respect to geographic distance, the relative distance between them and Beijing is negligible when the absolute distance is considered. Once Chinese contractors reach the LAC region, the distance between Mexico City/Buenos Aires and Beijing may not matter much.

One variable that has been used in the studies of FDI is the Chinese population in the host economies. The hypothesis is that the more Chinese live there, the stronger the economic ties exist between the host country and the Chinese business operation overseas. While this hypothesis may sound plausible for the countries in Chinese neighbourhood, typically in East and Southeast Asia, because of centuries of relationship, this pro-China phenomenon may not exist in Latin America where the Chinese population tends to be small anyway. Another difficulty is data availability on Chinese population in the LAC region. The main data sources for Chinese overseas population are the Yearbook of the Hua Ren Economy (All-China Federation of Returned Overseas Chinese 1998–2013) and the Blue Book of Overseas Chinese: Annual Report on Overseas Chinese Study (Overseas Chinese Affairs Office of the State Council 2013). However, none of the LAC economies covered in this study have complete data for this variable; most countries only have data for a limited number of years. As we conduct a panel analysis, such paucity and incompleteness of the time series on this variable prevent us from using it in the panel regression. Therefore, we conduct a pooled regression on Chinese population using the years and countries for which we have the data. We expect the effect of the Chinese population on Chinese contracts to be positive.

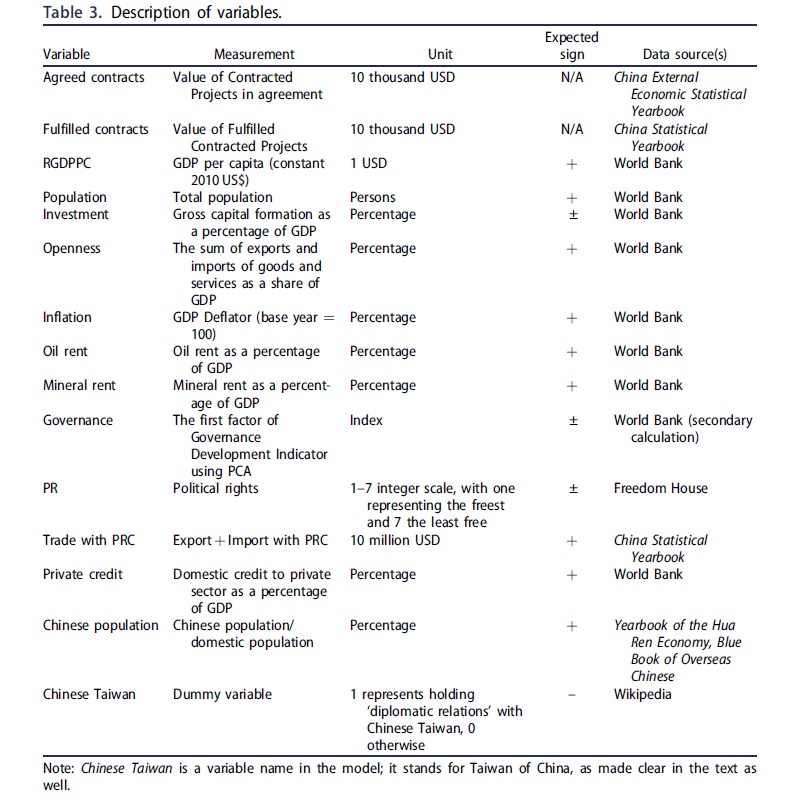

Table 3 lists information for the dependent and independent variables in terms of their expected sign, measurement, unit, and data source. Our data set includes 30 economies from 1998 to 2015 based on data availability; the names of these countries are listed in Table 4.

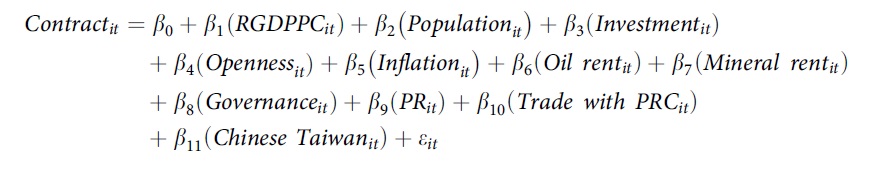

Based on the completeness of the data for the 30 LAC countries, the following model is specified for the panel regression,9 with i and t being subscripted to each variable representing a specific country and specific year, respectively (see the Appendix for the summary of statistics). Contract refers to agreed or fulfilled value of contracts. All variables are natural log-transformed except the variable Chinese Taiwan (hereafter‘Chinese Taiwan’in the regression tables):

Statistical results and analysis

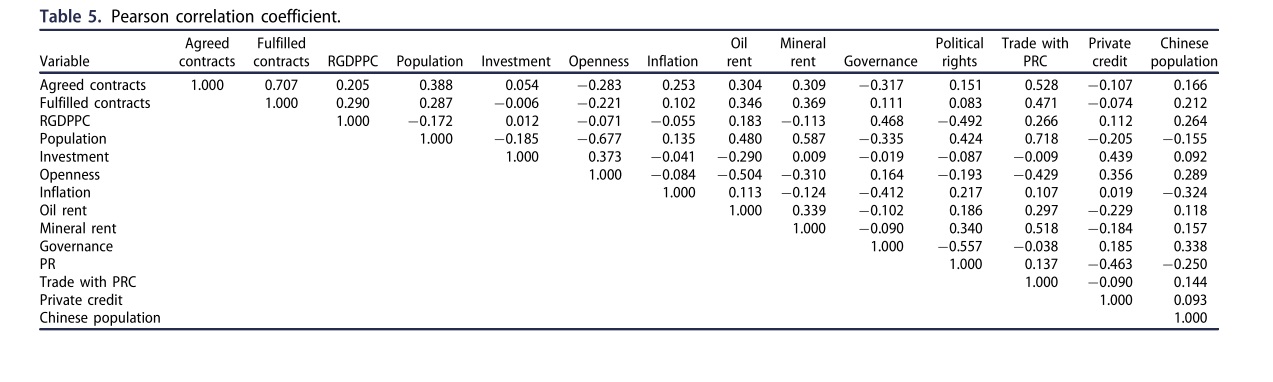

We first check the Pearson correlation to capture the bivariate association among these variables. The results are shown in Table 5. The correlation coefficient between agreed value and fulfilled value of contracts is 0.707, which is not very high considering the presupposed close relationship between the two; this result probably suggests that signing contracts and carrying out contracts in a country may not co-evolve perfectly and also that Chinese contractors continue to seek new grounds to open construction. This finding confirms our decision to use both the agreed and fulfilled value of Chinese contracts as the dependent variables, as their determinants may be different.

Contracts are positively correlated with population. Countries with a relatively large population tend to get contracts and get them completed. The positive coefficient of inflation confirms our previous discussion that the government’s expansionary macroeconomic policies would contribute to international contracts. Both oil rent and mineral rent are positively associated with contracts, demonstrating that one of the drivers for Chinese contracts in the LAC region is to guarantee and diversify its resource supply.

It is surprising to find that openness is negatively associated with Chinese contracts, which is opposite to our theoretical assumption, though this result may change in a multivariate analysis. The correlation between PRC’s trade and Chinese contracts suggests that the LAC countries that tend to trade with PRC also tend to receive contracts from it.

Among independent variables, governance and political rights are positively associated with real GDP per capita (a negative sign on the correlation between political rights and other variables means a positive correlation between political rights and others, because of the construction of the value for this variable as discussed earlier), demonstrating that high-quality governance and political openness may co-evolve with economic development in the host country. In addition, governance is also positively associated with political rights, indicating that democracy and governance go hand in hand with each other. In contrast, political rights and governance are negatively correlated with oil rent and mineral rent. In addition, economic openness is negatively correlated with both oil rent and mineral rent, suggesting that a LAC country that tends to focus on resources has a lower percentage of exports and imports in its GDP. Political rights and governance are negatively correlated with inflation. Trade with PRC is positively correlated with GDP per capita, population, oil rent and mineral rent. The LAC countries with higher income per capita and more population tends to trade with PRC more, which is consistent with the gravity model of trade. At the same time, China’s trade with LAC countries seems to favour natural resources.

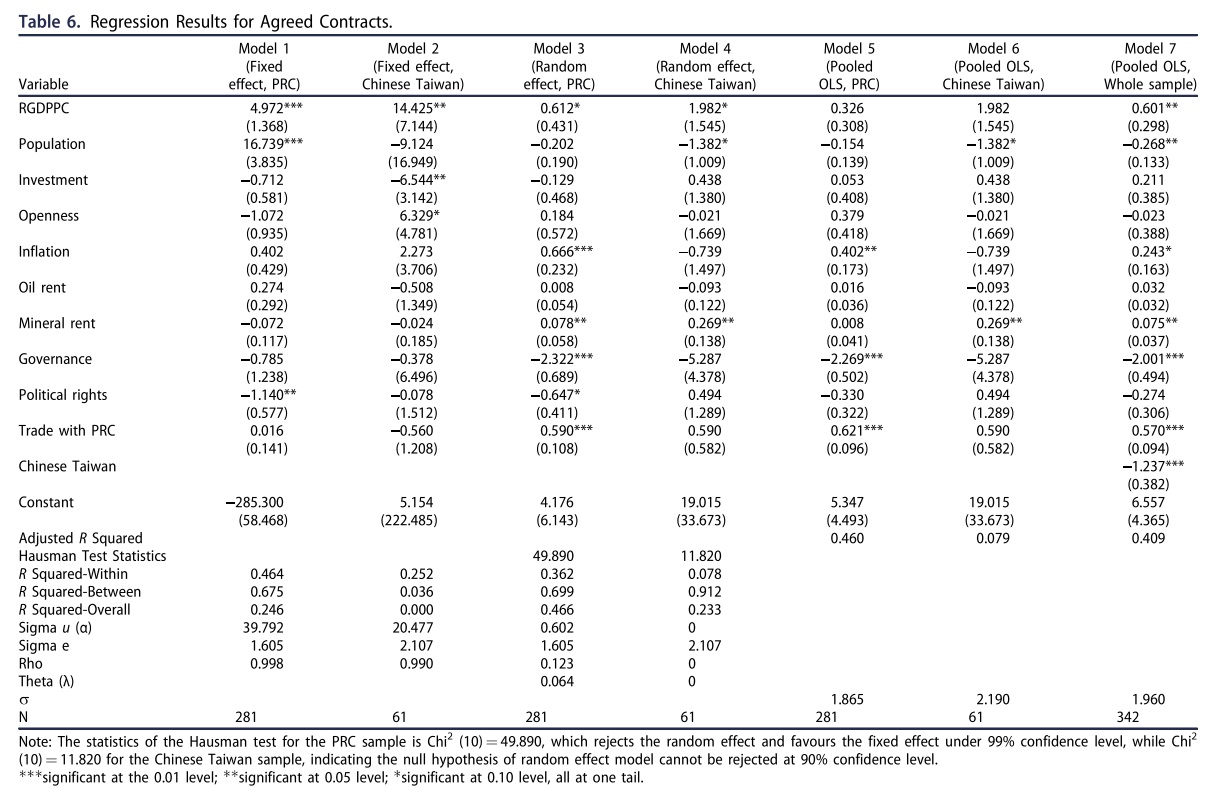

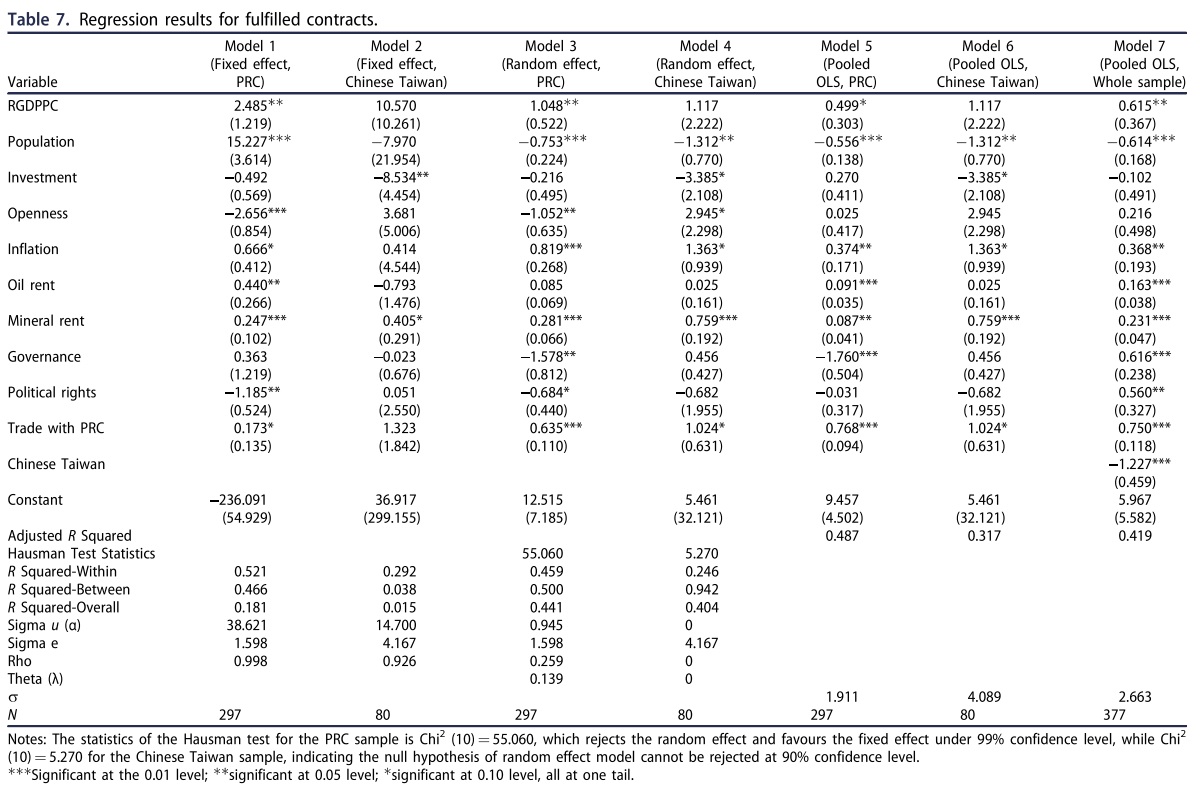

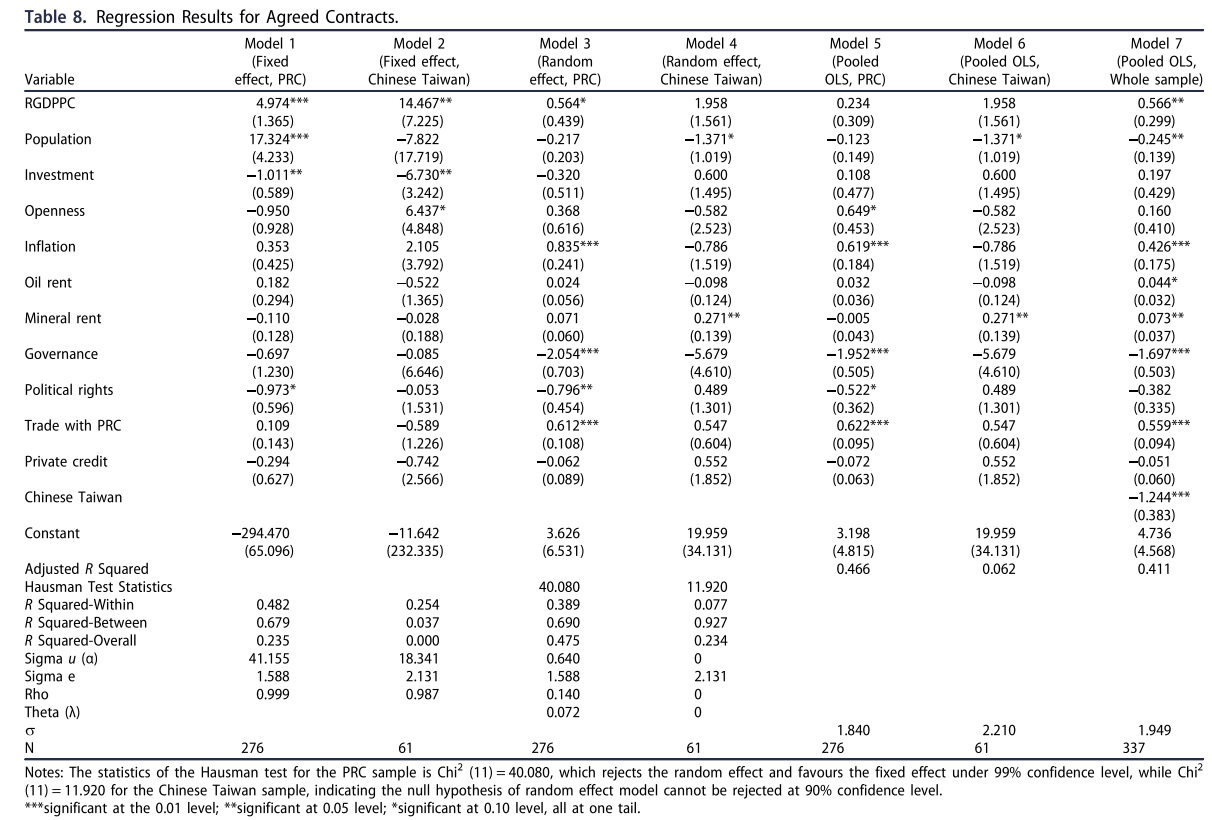

Since the correlation coefficients only capture a bivariate relationship without controlling for other factors, it is crucial to look into the empirical results based on the multivariate regression models. Our panel regressions consist of pooled Ordinary Least-Squares (OLS) estimation, as well as the fixed-effects and randomeffects models. In the pooled OLS estimation, we find a significant and salient negative effect of‘diplomatic relations’with Chinese Taiwan on Chinese contracts (Model 7, Tables 6 and 7). As the determinants for Chinese contracts may experience a parametric structural break between the LAC economies that have‘diplomatic relations’with Chinese Taiwan and those that do not, we decide to use a Chow test to test the structural stability of the parameters between the two sub-samples. The F statistics of the Chow test for the agreed contract model and the fulfilled contract model are 4.65 and 6.47, respectively, over the critical value at the 5% error level (1.82), and reject the null hypothesis that there is no parametric break. The result from the Chow test procedure indicates a significant difference in the determinants of Chinese contracts between these two groups. Therefore, we decide to run regressions on the two sub-samples separately.

The other statistical issue encountered in our panel data is the use of the random effects model over that of the fixed effects model. If there is no fixed effect, then the random effects model will be preferred, on the basis of efficiency in estimation. Otherwise, the fixed-effects model will be used to produce unbiased estimates. We adopt the Hausman test to make a determination on this issue. Based on the Hausman test, we focus on the appropriate fixed-effects model or random-effects model in our analysis of the PRC sample or Chinese Taiwan sample.

The PRC sample

Table 6 displays the empirical results using the agreed contracts as the dependent variable. Under the fixed-effects model (Model 1, Table 6) for the sub-sample of the countries that have diplomatic relations with the People’s Republic of China (hereafter ‘PRC’ in the regression tables), the relatively well-to-do economies in the LAC region are more capable of attracting Chinese contractors, consistent with the studies of market-driven determinants of FDI. Population also has a positive effect on Chinese contracts. Finally, political openness has a positive effect on Chinese contracts.

Table 7 shows the empirical results, using the fulfilled contracts as the dependent variable. In the fixed-effects model for the PRC sample (Model 1, Table 7), the parameter estimates for real GDP per capita and population remain positive and statistically significant. In addition, the effect of openness is negative and statistically significant. Four additional variables become statistically significant when the dependent variable is fulfilled contracts: inflation, mineral rent, political rights, and trade with PRC.

A LAC country with an expanding economy and a relatively large trading relationship with China has a better chance of seeing the completion of Chinese contracts. Both variables may indicate macroeconomic conditions favourable for the fulfillment of the contracts. PR, the political rights variable, which takes a negative sign, suggests that the relatively politically free LAC countries tend to have Chinese contracts completed (note that PR ranges from 1 to 7, with 1 indicating the freest and 7 indicating the least free). Since most of the contracted projects that Chinese contractors undertake are related to large-scale infrastructure construction, the higher level of credibility and property rights protection in the host countries are conductive to their completion. Also, in those economies where the degree of political rights is higher, the government is under more pressure to provide public goods including infrastructure, thus raising the likelihood of the completion of the contracts. Finally, mineral rent is now statistically significant and positive. Together with oil rent, it is an indicator of the country’s specific endowment that attracts Chinese contractors, who tend to work in LAC countries that are abundant in natural resources.

The Chinese Taiwan sample

Compared with the above results for the PRC sample, the results for the sample of the countries that have ‘diplomatic relations’ with Chinese Taiwan are very different. When the dependent variable is the agreed value of contracts, using the randomeffects model (Model 4, Table 6), though the effect of GDP per capita is positive, population takes a wrong sign (negative). The other variable statistically significant is mineral rent. Among the countries that have ‘diplomatic relations’ with Chinese Taiwan, those abounding with mineral resources tend to attract Chinese contracts.

When the dependent variable is the fulfilled value of contracts using the random-effects model (Model 4, Table 7), similarly, GDP per capita is not statistically significant and population again takes a wrong sign. The sign on investment is negative and statistically significant, indicating that a higher domestic investment share of GDP results in a lower level of Chinese contracts completed. Openness and inflation are marginally significant and positive, confirming the positive impact of the expansionary macroeconomic policies of the host country. In addition, mineral rent and trade with PRC both have a positive effect on the completion of Chinese contracts.

In conclusion, Chinese contractors do not go to the countries that have‘diplomatic relations’with Chinese Taiwan as much as those that have diplomatic relations with PRC. By comparison, the Chinese contractors are not attracted by GDP per capita or population of the countries that have foreign relations with Chinese Taiwan. With that said, if Chinese contractors do enter a country that has ‘diplomatic relationship’ with Chinese Taiwan, then some economic factors do have impact on completed contracts. Those with relatively higher inflation, abundant in minerals, and trading more with PRC tend to have more Chinese contracts completed in terms of dollar value. In contrast, those that have a higher percentage of domestic investment in GDP tend to have a lower level of Chinese contracts completed.

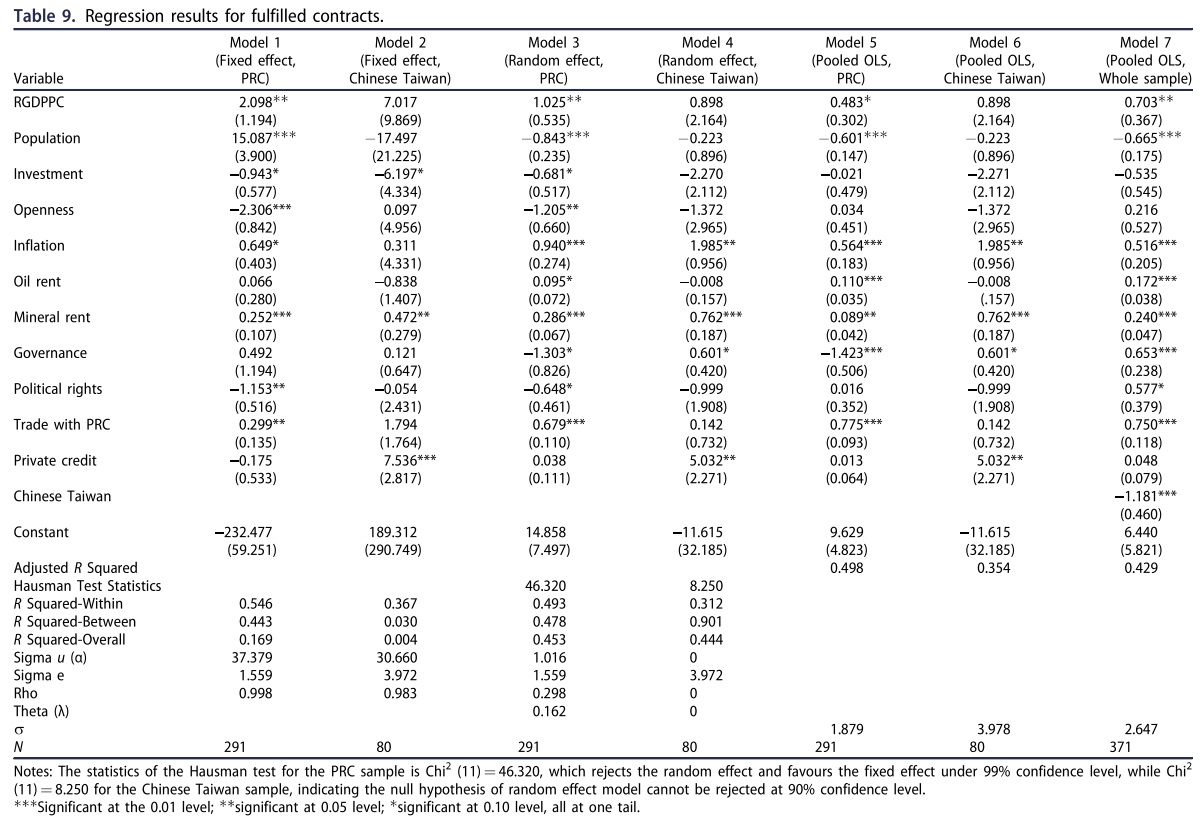

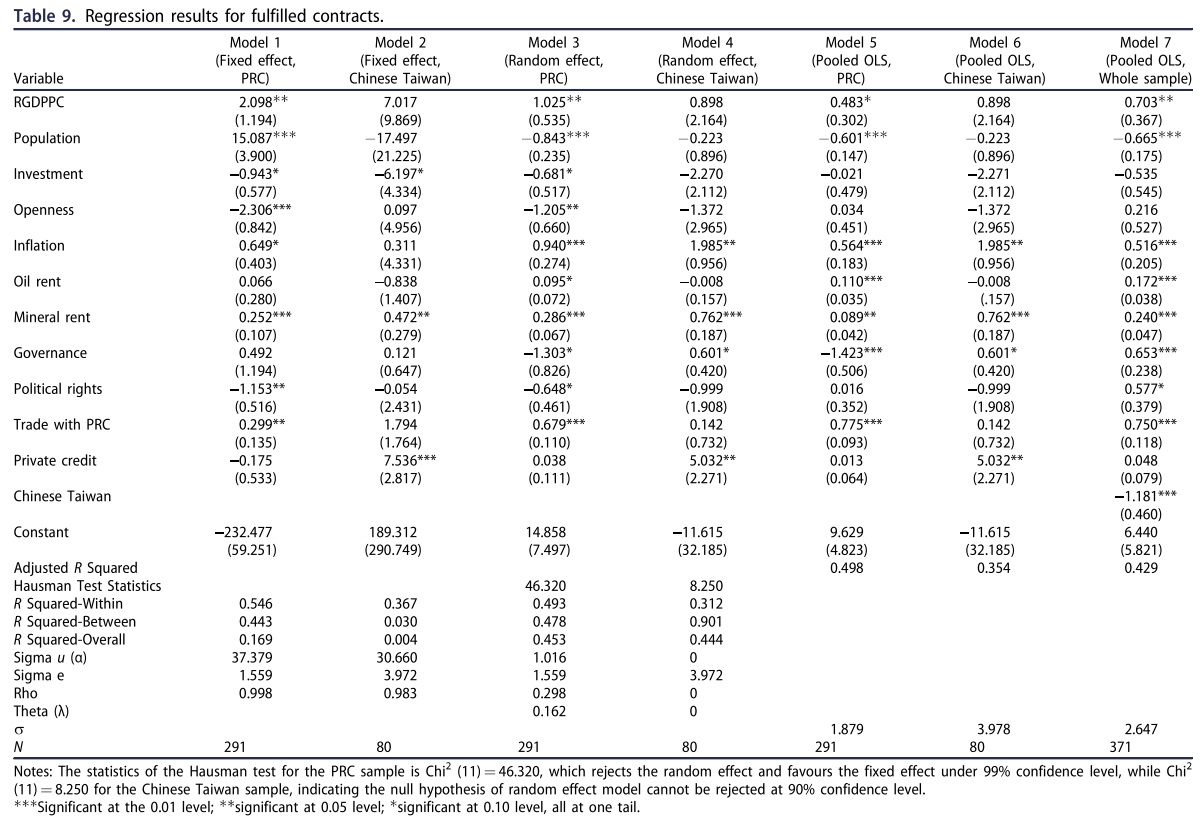

As the next step, we perform a sensitivity analysis adding the ratio of private credit to GDP to the model specification. We expect the credit variable to hold a positive effect on Chinese contracts, as it reflects in general the quality of institutions of the host economy and relative degree of private lending. In addition to testing the validity of the effect on Chinese contracts of institutional quality as measured by private credit, the use of private credit also serves as a check on the robustness of the regression results in Tables 6 and 7.

The PRC sample

With respect to the agreed value and using the fix-effects model (Model 1, Table 8), for the PRC sample, the signs on the size of the economy and population continue to be positive and statistically significant. However, the effect of domestic investment on Chinese contracts is negative and statistically significant. There appears to be a crowding-out effect of domestic investment on Chinese contracts. Finally, the countries that have relatively open political systems tend to attract Chinese contracts. When the dependent variable is the fulfilled contracts and using the fixed-effects model (Model 1, Table 9), both GDP per capita and population remain statistically significant and positively signed as before, when private credit is added. In addition, openness has the negative effect, and inflation and political rights hold the positive impact on the completion of Chinese contracts. Trade with PRC exhibits positive impact on Chinese contracts. Finally, the effect of mineral rent is statistically significant and positive.

The Chinese Taiwan sample

In contrast, the revised model using the random-effects model, in the same way as in Table 6, does not work well for the Chinese Taiwan sample with the dependent variable as the agreed contract value (Model 4, Table 8) in terms of the size of the economy and population. GDP per capita is not statistically significant; population takes a wrong sign. The only significant and correctly signed variable is mineral rent. When the dependent variable is fulfilled contracts and using the random-effects model (Model 4, Table 9), what matter for the Chinese contractors will be mineral rent, an expanding economy, governance and private credit. The combination of these results suggests that though Chinese contractors have much fewer contracts with the countries that recognise‘diplomatically’Chinese Taiwan, they do go to some of them and more importantly, complete the projects particularly when they have mineral resources, monetary expansion, and relatively good governance and relatively high quality of investment infrastructure as indexed by private lending.

Finally, we consider the Chinese population by including it with the variables that are statistically significant in the respective models. Because the data on Chinese variables have many missing values, we use pooled regression based on the available data of the Chinese population. We find that Chinese population is positive and statistically significant at the 0.05 error level in a one-tail test among three out of four sets of regressions: agreed contracts and fulfilled contracts for the PRC samples, and agreed contracts for the Chinese Taiwan sample. The evidence is that the Chinese population of the host countries does have some positive effect on the attraction or completion of the Chinese contracts.

Conclusion remarks

This paper studies the determinants of Chinese contracts in the LAC region. The empirical results support the argument that one of the most essential motives for China to strengthen its economic cooperation with LAC countries is to diversify its supply of natural resources, as those countries that have mineral resources appear to attract Chinese contracts. In addition, level of development, population, and inflation are all conducive to Chinese contracts. Finally, Chinese contractors tend to find projects completed in the countries where political rights are of relatively high level. The above scenario is consistent and common with the LAC countries that do not recognise‘diplomatically’the government of Taiwan of China. For the countries that have‘diplomatic relations’with Chinese Taiwan, economic factors such as the level of development and population would not matter in the same way as they do among the countries that have diplomatic relations with PRC. However, if these countries have a high level of mineral resources,then Chinese contractors may find themselves there.

While this essay identifies some determinants that attract Chinese contractors to the LAC region, a remaining question is: How do we evaluate long-term implications of Chinese contracts in the region? Our work analyses the determinants of contracts; however, it does not evaluate the success or failure of these contracts in the long term, particularly after the project is handed over to the owner.12 Furthermore, it will be essential to investigate whether Chinese contracts will significantly raise the level of livelihood, reduce poverty, and narrow income inequality in LAC countries. China is undergoing a massive transition of economic development and is advancing its participation in the global economy, Chinese companies will continue to seek opportunities in other economies. China's political and economic influence will continue to increase with successful contracts in other parts of the world and will suffer damages if the contracts go wrong.

The LAC region has immense economic potentials with abundant natural resources, human capital, and creativity. It also holds important political influence cemented by the common history, language, and endowment across different countries in the region. Because of geographic proximity and historical similarities, the US and LAC are considered naturally bonded. Now, with the rise of China, it will be interesting to find out if their relations are affected in the context of China’s dynamic expansion of its political as well as economic influence in the region. Chinese contractors are the agents in this litmus test.

Programs

Programs